The original post (copied below) and the rest of the "collection of the most important, exciting, and innovative people, ideas, and projects making our world better" can be found

here.

Here Comes the (Chinese) Sun: How Chinese innovation is going to revolutionize solar power for the rest of the world

Residents of the city of Rizhao claim to be the first Chinese to greet the sun each day as it rises from the Yellow Sea. In fact, the city’s name is a condensed form of the Chinese phrase

ri qu shien zhao, which literally means “first to get sunshine.” They also make some of the best use of the more than 100 kilowatt-hours of power the sun pours down on each square meter of Earth over the course of a sunny day.

Though Rizhao’s 3 million residents are seemingly overshadowed by nearby Qingdao—a larger city famous worldwide for its eponymous beer (you might know it as Tsingtao)—Rizhao boasts perhaps a bigger distinction: It is the first city in all of China to pledge to become carbon-neutral.

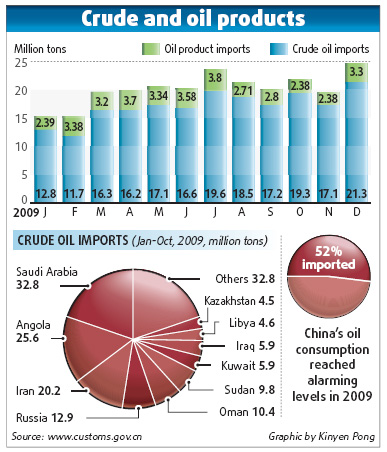

That China has surpassed the United States to become the leading emitter of greenhouse gases is no secret. The Chinese curse on the climate will have to be reckoned with, but the Chinese also have a gift to give the world: developing cheap renewable energy sources, particularly solar power. Low-cost manufacturing in China is transforming the entire array of clean energy sources, like previously expensive photovoltaic cells—and, in the process, helping to clean up the world’s energy supply.

Witness Rizhao. Rooftops in newly constructed apartment blocks as well as on the houses in the surrounding countryside are often covered in angled panels of dark tubing. The tubes soak up sunlight, using its warmth to heat water within and eliminate the need to burn fossil fuel or suck up electricity for that purpose. Such solar hot-water heaters are mandatory, and are responsible (along with all the city’s other solar efforts) for cutting energy use compared to alternatives by 348 million kilowatt-hours per year—cutting greenhouse gases at the same time. That’s enough electricity to power more than 30,000 U.S. homes for a year.

Indeed, China has become the world’s largest market for and producer of such solar hot-water devices, which have become cheaper than traditional electric or gas-fired varieties thanks to this growing demand. Companies like Himin Solar Energy Group churn out solar hot-water heaters from factories big enough to build jumbo jets; China as a whole installed 246 million square feet of solar hot-water-heater panels in 2007.

And it’s not just hot water that Rizhao gets from the sun, as evidenced by the gleaming arrays of blue-black photovoltaic cells beneath the lampposts lining the seashore of this resort town.

Rizhao has company in its use of the sun. In Jiangsu Province outside Shanghai lies China’s “Solar Valley,” which took its name from our own Silicon Valley, and which focuses on the same element. After all, silicon, a semiconductor, is an important component of both computer chips and solar cells.

Suntech, a photovoltaic company with the world’s largest production capacity and JA Solar both have facilities in Jiangsu; globally, Suntech can churn out enough panels in a year to produce—under ideal conditions—1 gigawatt of energy.

Suntech alone has given China—and the world—its first solar billionaire: Shi Zhengrong, who has built the company into a solar powerhouse since its founding, in 2001. And unlike competitors such as Q-Cells, from Germany; Sharp, from Japan; and the U.S.-based SunPower; among others, Suntech has opted not to automate its production processes.

“We’ve chosen to rely on labor for the obvious reason of cost: Labor rates are so much lower [in China],” says Steve Chadima, the U.S. spokesman for Suntech. “We can more easily crank up or down our operations depending on market demand.”

And it’s not just workers that come cheap in China: “Glass, aluminum—all those materials are less expensive in China than they are in the U.S. or Europe,” Chadima notes. “All the way around there’s low cost.”

That has led many foreign manufacturers to open operations in China or elsewhere in Asia. Evergreen Solar, for example, a Massachusetts-based company, recently opened a Chinese factory, while panel producer First Solar has built several factories capable of cranking out more than 500 megawatts’ worth of solar cells in Malaysia.

And that means, ultimately, cheap solar power. “It’s very possible to get down to something in the range of one dollar per watt to manufacture a silicon solar panel,” Chadima says, though U.S. panel prices in July were more than $4.50 per watt.

But, as an example, Chadima points to the 30-megawatt system that the power company Austin Energy is building with Suntech PV modules in Texas. Austin Energy expects to charge just 17 cents per kilowatt-hour of electricity. That’s not much more than the roughly 13 cents per kilowatt-hour residential customers paid on average for electricity this past May in that state.

“In the case of solar, China has an advantage in its manufacturing capacity,” says Li Junfeng, the secretary general of the Chinese Renewable Energy Industry Association. “It can produce large quantities of products at a relatively low cost.”

Cheap, in this case, does not mean poor quality. Suntech, for example, is considered one of the top five solar-cell producers in the world in terms of quality and has been used in projects from Germany to the United States.

“Within three to four years, we’ll be talking about the pure economic benefit of photovoltaics.”

Like its international competitors, Suntech offers a range of products, including advanced solar cells; its highly efficient, more expensive Pluto module can turn as much as 19 percent of the sunlight that falls on it into electricity. “In this case, you’ve got essentially a company known as a low-cost leader but, at the same time, introducing some of the highest technology in the world,” notes Bates Marshall of Sixtron, a Canadian company that peddles solar-cell-manufacture technology.

Across the market, however, quality can still be a concern. While some of the finest solar cells in the world come from China, there are a host of smaller companies producing even cheaper, lower-quality cells. “There are three to five name-brand module companies and maybe 160 total module manufacturers,” Marshall adds. There are “a lot of no-name panels coming out of China that have some dubious quality.”

Regardless, as soon as 2011, Marshall predicts, modules could cost as little as $1.40 apiece, which will put them in the same price range as other energy sources. “Within three to four years, we’ll be talking about the pure economic benefit of photovoltaics,” Marshall says.

And that’s just in the United States. “All the solar photovoltaics are for export with a very small share for domestic use,” CREIA’s Li notes of Chinese-made solar panels. But “Chinese companies are being optimistic about the future because the government has set all these targets for carbon-emission reduction.”

Rizhao, for its

Rizhao, for its part, has a host of clean competitors—and that’s a good thing. Dezhou City, also in Shandong Province, boasts Himin’s 200,000-square-foot factory for making solar hot-water heaters as well as other solar-power manufactures. Baoding, a city in Hebei Province, offers solar, wind, and other renewable energy manufacturing. And Wuxi, in Jiangsu, is home to Suntech, among others. The Chinese government, for its part, aims to install 1.8 gigawatts of solar power nationwide by 2020—but expects to more than quadruple that goal on current progress.

Rizhao is one of just four cities worldwide to even attempt so-called carbon neutrality (the others being Arendal, Norway; Vancouver, Canada; and Växjö, Sweden), according to the United Nations Environment Programme.

To reach its goal, Rizhao will have to employ an arsenal of environmental improvements, from a so-called circular economy, in which industrial waste gets cycled back as energy, to harvesting the power offered for free by the city’s 260 days of yearly sunshine.

As a result of these efforts, Rizhao, unlike the rest of China, is using nearly a third less energy while cutting its carbon dioxide emissions by 50 percent.

Solar, it seems, is rising in the east.

Suntech alone has given China—and the world—its first solar billionaire: Shi Zhengrong, who has built the company into a solar powerhouse since its founding, in 2001. And unlike competitors such as Q-Cells, from Germany; Sharp, from Japan; and the U.S.-based SunPower; among others, Suntech has opted not to automate its production processes.

Suntech alone has given China—and the world—its first solar billionaire: Shi Zhengrong, who has built the company into a solar powerhouse since its founding, in 2001. And unlike competitors such as Q-Cells, from Germany; Sharp, from Japan; and the U.S.-based SunPower; among others, Suntech has opted not to automate its production processes. Rizhao, for its part, has a host of clean competitors—and that’s a good thing. Dezhou City, also in Shandong Province, boasts Himin’s 200,000-square-foot factory for making solar hot-water heaters as well as other solar-power manufactures. Baoding, a city in Hebei Province, offers solar, wind, and other renewable energy manufacturing. And Wuxi, in Jiangsu, is home to Suntech, among others. The Chinese government, for its part, aims to install 1.8 gigawatts of solar power nationwide by 2020—but expects to more than quadruple that goal on current progress.

Rizhao, for its part, has a host of clean competitors—and that’s a good thing. Dezhou City, also in Shandong Province, boasts Himin’s 200,000-square-foot factory for making solar hot-water heaters as well as other solar-power manufactures. Baoding, a city in Hebei Province, offers solar, wind, and other renewable energy manufacturing. And Wuxi, in Jiangsu, is home to Suntech, among others. The Chinese government, for its part, aims to install 1.8 gigawatts of solar power nationwide by 2020—but expects to more than quadruple that goal on current progress.